Latest Update on PAN Aadhaar link status: The government has now closed the PAN AADHAAR linking facility. The last date for linking PAN with Aadhaar was 30th June ’23. Now, in case you want to link your Aadhaar with PAN you have to pay a penalty of Rs. 1000/- and than only your PAN will be reactivated. Your PAN will not operative unless and until you pay the penalty of Rs. 1000/-

It was long ago when the government has made the PAN Aadhaar linking mandatory for every individual. Finally government announced the last date for PAN Aadhaar linking which was 30th June ’23. And since we all know the last date has passed long ago and still there are some individuals who forgot or ignored this process of PAN Aadhaar linking. Their PAN card has been made inoperative from 1st July ’23 onwards. They have to link their PAN Aadhaar now to activate their PAN card which they can do after paying a penalty fee of Rs. 1,000/-.

Latest Update

The last date for linking your Aadhaar with PAN is 30th June 2023. After this deadline your PAN will become inoperative if it is not linked with Aadhaar.

Check online your Aadhaar PAN Link Status

There are many ways to check online your PAN Aadhaar link status, as given below:

1. Visit your Bank Branch

If you have a Bank account you can visit your Nearest bank branch and enquire for PAN Aadhaar link status. At the enquiry counter or a Executive at the Bank branch will check and let you know about your AADHAAR PAN link status. If the PAN Aadhaar is not linked than your PAN has been inoperative and so your BANK Account. So, its really very important to check your PAN AADHAAR Link Status.

2. Check on Income TAX Portal

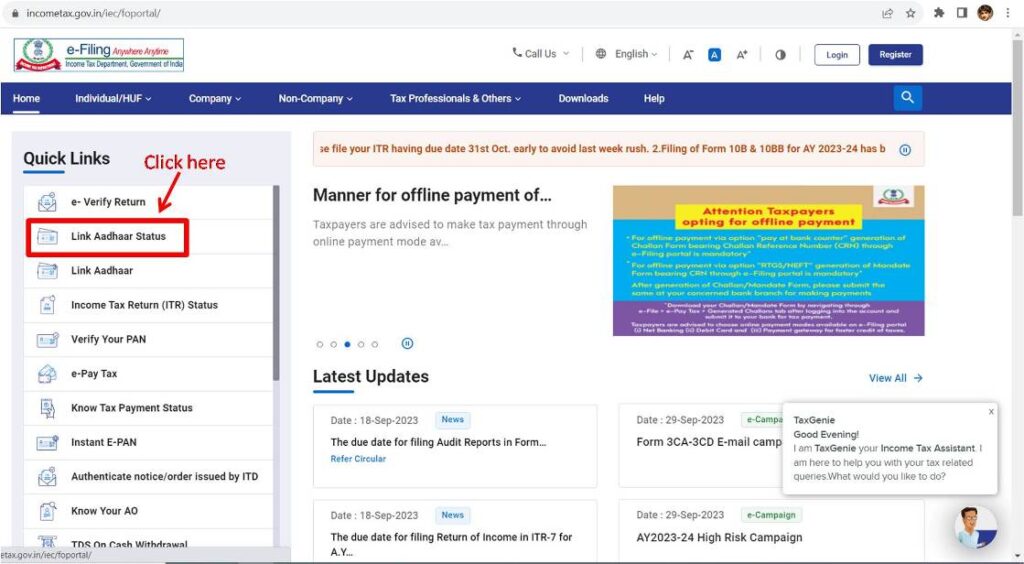

You can simply check your PAN Aadhaar Link status on Income TAX website as shown below:

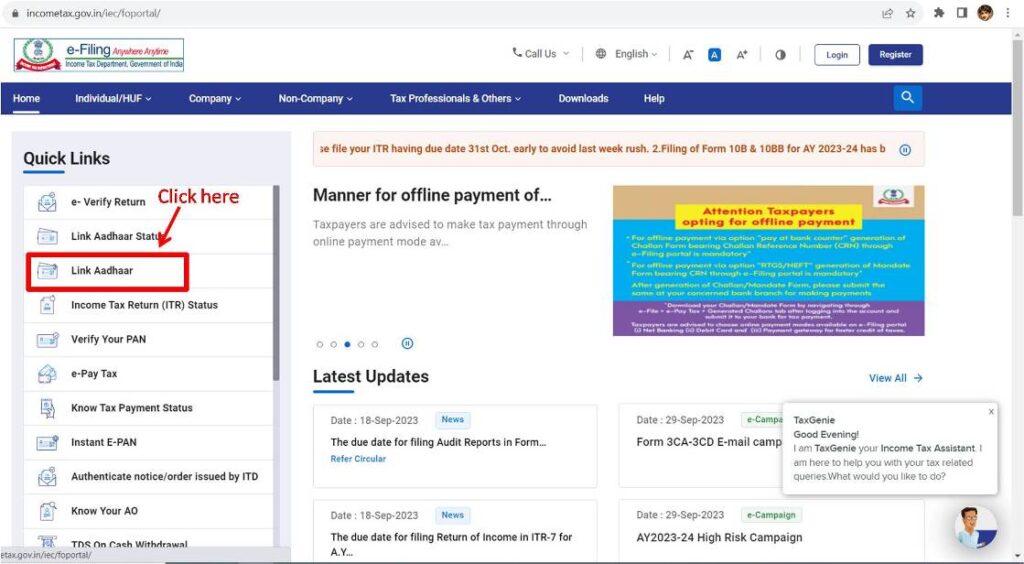

Step #1: Go to Income TAX Website at: http://www.incometax.gov.in/iec/foportal/

Step #2: On the Left hand side “Quick Links Menu” you will see a menu option “Aadhaar Link Status” as shown in the Screenshot below.

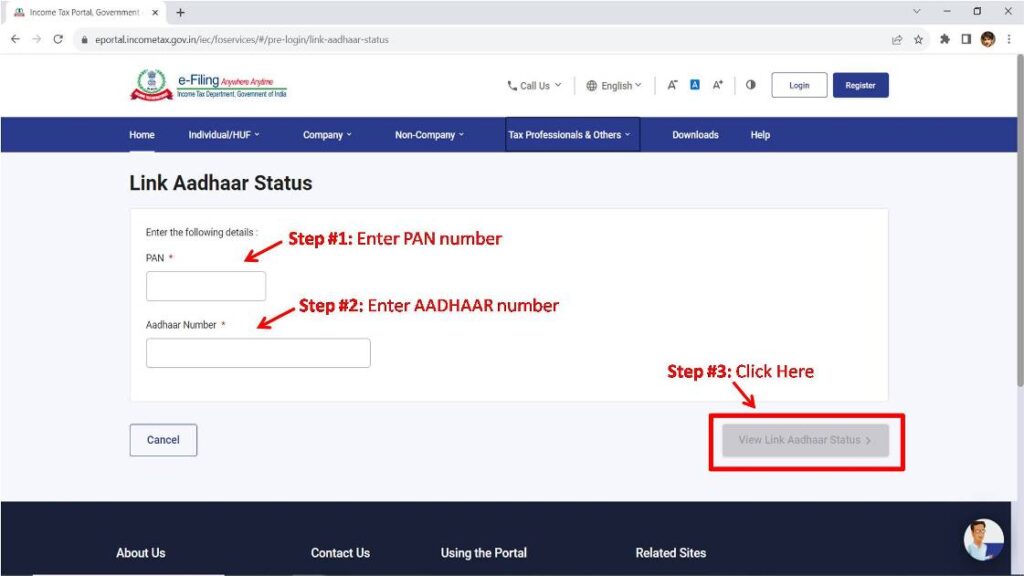

Step #3: On the landing page, you will see 2 text fields where in the first one you have to enter your PAN card number and in the 2nd one you have to enter your Aadhaar number. Then click on the button which says “View Link Aadhaar Status” as shown below:

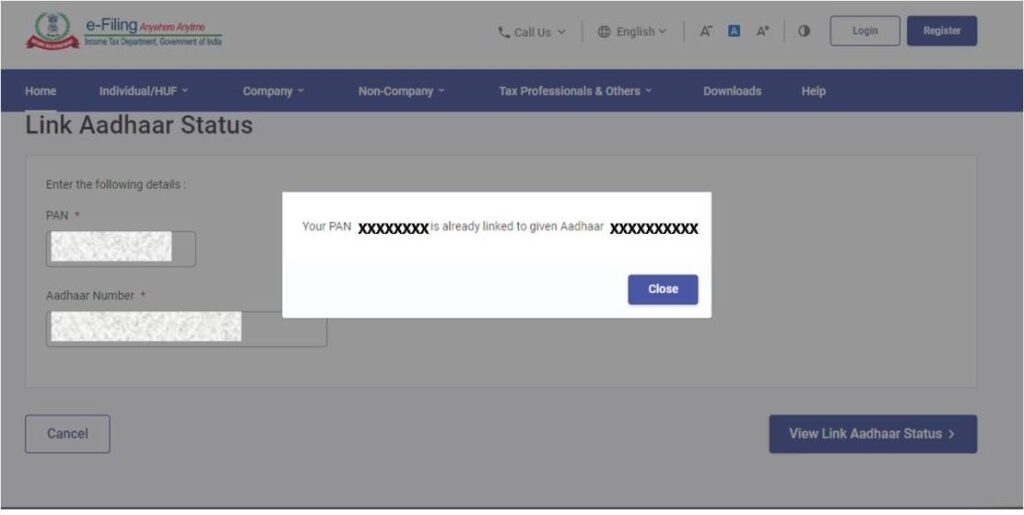

Step #4: A pop up window will appear giving your PAN Aadhaar Link Status. There are 3 possibilities:

i. If your Pan Aadhaar has been already linked it will say “Your PAN is already Linked to given Aadhaar” as shown below:

ii. If your PAN is not linked to the given Aadhaar the window will say PAN not linked with Aadhaar. Please click on “Link Aadhaar” link to link your Aadhaar with PAN.

You can also login into your account on Income TAX Portal and check the Pan Aadhaar link status in the Profile Page > Link Aadhaar Status

PAN Aadhaar Link Status Check by SMS

The simple process for Checking PAN AADHAAR Link status via SMS is as follows:

Step #1: Open your Messaging App

Step #2: Create a New Message and type “UIDPAN <12 Digit Aadhaar Number> <10 Digit PAN Number>”

Step #3: Send the Message to any one of these numbers ‘567678’ or ‘56161’.

Step #4: You will receive a response with your Pan Aadhaar Link status on your registered mobile number.

How to link Aadhaar with PAN Card online after Deadline – Step by step Instructions

As you have checked and found that your PAN and Aadhar is not linked and you have to Link your PAN and Aadhar now. In this case, you have to pay a penalty fee of Rs. 1,000/- before submitting your Aadhaar pan Link request. Here is the step-by-step instructions given below for linking your pan with Aadhaar online after deadline with payment of penalty fee.

For Aadhaar Pan linking, you will require following:

- Your PAN Number

- Your Aadhaar number

- A valid Mobile number (already linked with Aadhaar)

Before submitting, the PAN Aadhaar Link status, you need to pay the penalty fee. After that only in the next step you will be able to submit your Aadhaar Pan linking Request. These both steps are to be done separately.

Step by Step Instructions for linking Pan with Aadhaar online:

A. How to make Payment of Penalty fee for Aadhaar Pan linking on e-Filing Portal

Step #1: Visit the e-Filing Portal Home page and on the left hand side, in Quick Links section click on Link Aadhaar. Or else you can login to your account on e-filing portal and click on Link Aadhaar in Profile section.

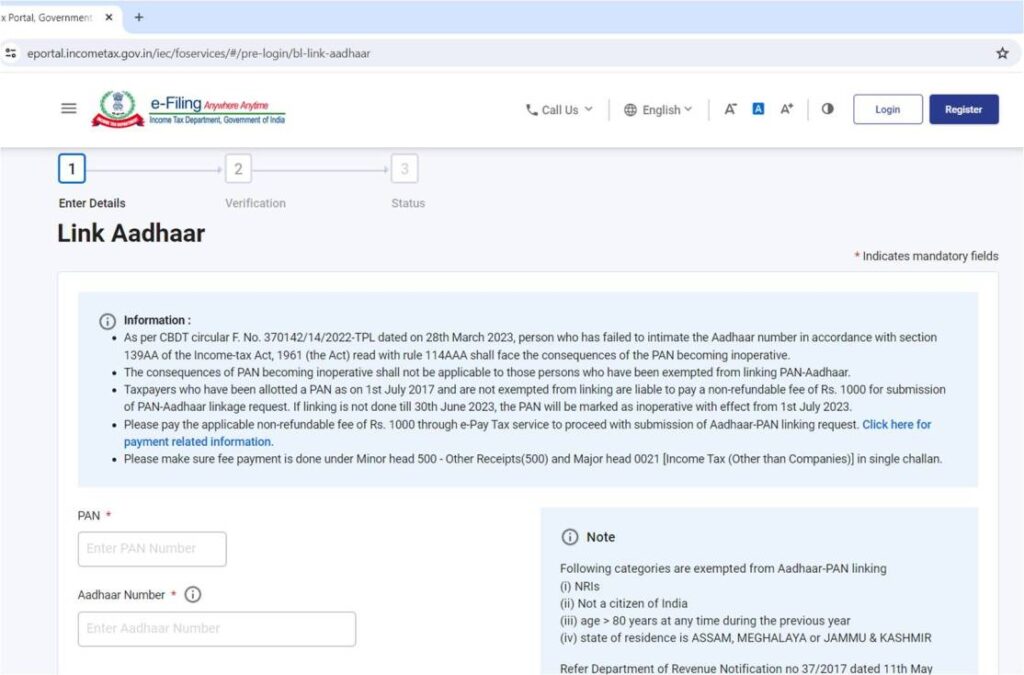

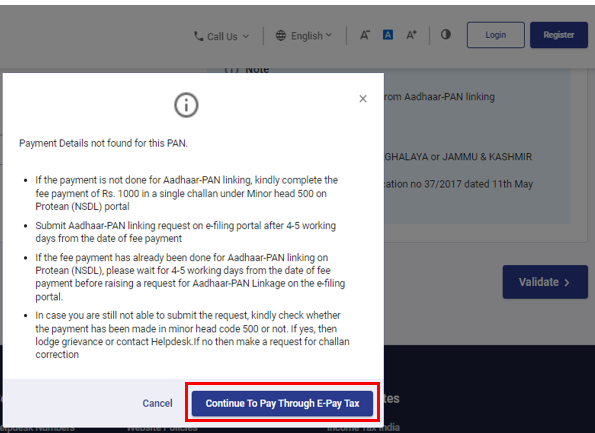

Step #2: Enter your PAN and Aadhaar number and click on Validate button. A popup will appear as shown below.

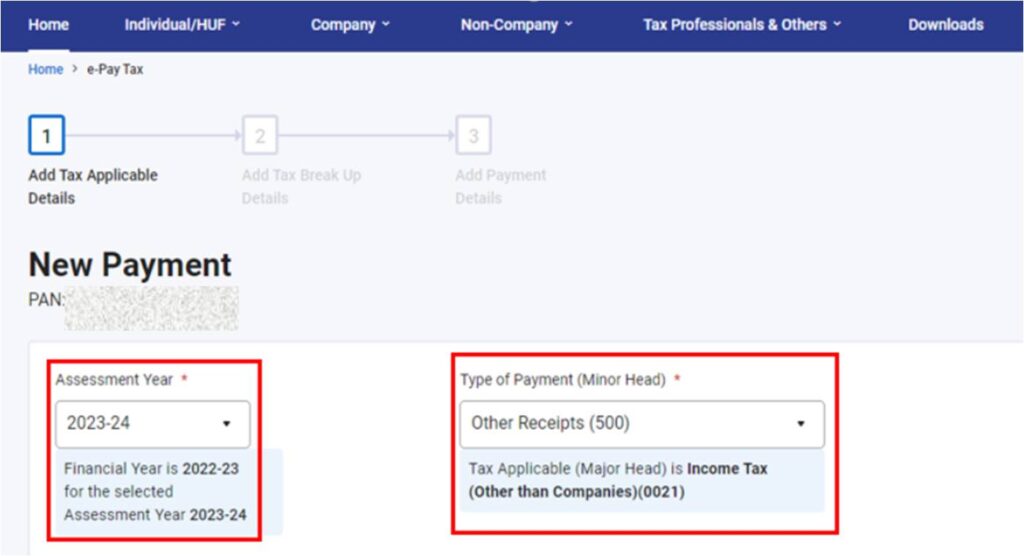

Step #3: Now click Continue to Pay Through e-Pay Tax. You need to enter your and confirm your PAN and Mobile number to receive OTP. After successful verification through OTP, you will be redirected to e-Pay Tax page. On this Page, you have to select Income Tax box and click proceed. Now select the Assessment Year and Type of payment as Other Receipts (500).

Step #4: Select below, the sub type of payment as Fee for delay in Linking PAN with Aadhaar. Here you will need to Pay Rs. 1,000/- as Penalty Fee for Aadhaar Pan linking which will be showing under Others Heading with amount prefilled. To proceed with the payment click Continue. You will be redirected to select the Mode of Payment, and after successfully completing the payment you can link your Aadhaar with Pan.

B. Submit Request for Aadhaar Pan Linking

For Aadhaar Pan linking you can submit request without login also.

Step #1: Visit the e-Filing Portal Home page and on the left hand side, in Quick Links section click on Link Aadhaar. Or else you can login to your account on e-filing portal and click on Link Aadhaar in Profile section.

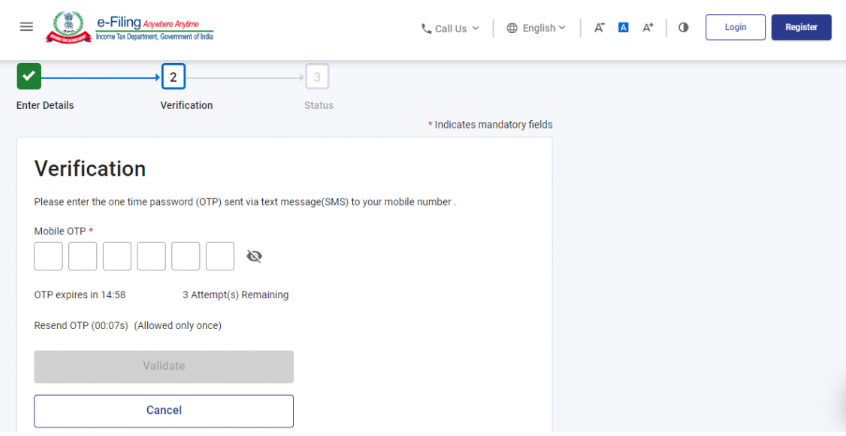

Step #2: Here you will be asked to enter mandatory details like, PAN number, Aadhaar number, Name on Aadhaar, and Mobile number. All provided details should match with your PAN details. Than click on Link Aadhaar Button where you have to enter 6 Digit OTP that you are going to receive on your mobile number (linked with Aadhaar).

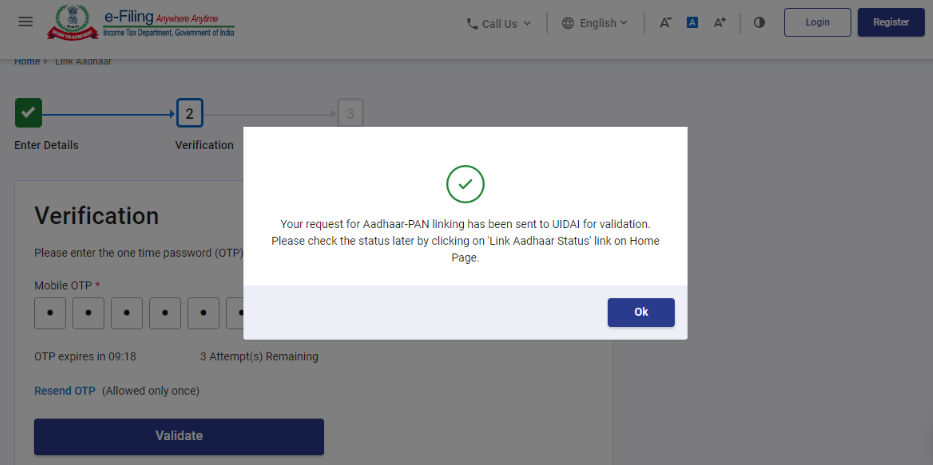

After verifying with OTP, you will get a confirmation message that the request for linking Aadhaar with Pan has been submitted to UIDAI successfully.

Although the request has been submitted as of now, but the reactivation of your PAN may take upto 30 days. Now you can check your Aadhaar Pan link Status by different methods as already discussed above. For checking PAN Aadhaar Link Status by SMS, you can refer to this section PAN Aadhaar Link Status Check by SMS above.

The above information is provided for general guidance only. Individuals are requested to check for updated information, clarifications and official notifications, released by Income Tax department.

Read More, What are the Benefits and Scope of doing MBA in 2024

Frequently Asked Questions (FAQs)

Pan-Aadhaar linking authentication get failed, what should I do?

The authentication failed message is received mainly when the details on Pan and Aadhaar mismatches. You need to check details like, Name on Aadhaar and Pan, Date of Birth, Mobile number, and other details, which should be same on Pan and Aadhaar.

How can I check my Aadhaar PAN link status?

You can check Aadhaar Pan link status on e-Filing Portal, where you can Check your Link Aadhaar Status. The process has been explained in this article in detail.

How to link PAN with Aadhaar after 30 June 2023?

Linking Pan with Aadhaar after the deadline of 30th June 2023, requires payment of Rs. 1,000/- as Penalty Fee. After payment you can submit Pan Aadhaar Link request on e-Filing portal. Since the Pan card has been made inoperative after 30th June 2023, the PAN reactivation process may take upto 30 days.

How many days to link Aadhaar to PAN after payment?

After payment, the Pan Aadhaar Link process not take much time. However, the reactivation of PAN card may take upto 30 days, which has become inactive after 30th June 2023.

Who is exempted from linking Aadhaar with PAN?

The following individuals are kept exempted from linking Aadhaar with Pan:

– Residents of the states of Assam, Jammu and Kashmir, and Meghalaya;

– Non-residents as per the I-T Act, 1961;

– Individuals aged 80 years and above during previous year;

– and, those who are not Citizens of India

What is the Penalty Fee for PAN Aadhaar link in 2024?

The Penalty Fee for not linking Pan with Aadhaar before 30th June 2023 is Rs. 1,000/-, and also, the Pan card will become inoperative.

How can I check my PAN card is Active or not?

If your PAN Aadhaar has not been linked before 30th June 2023 than your Pan card have been made Inactive or inoperative. You can check your Pan card Status as per the process below:

Step-1. Visit e-Filing Portal

Step-2. Click on ‘Verify Your PAN’ from left hand Quick Links Menu

Step-3. Enter the PAN number, Full Name (same as in the PAN), Date of Birth and Mobile number and click on ‘Continue’.

Step-4. An OTP will be sent to your Mobile number. You will be asked to enter OTP and click on ‘Validate’ button.

What happens if PAN is not linked to Aadhar?

If Pan is not Linked with Aadhaar, your PAN card will be inactivated. For Reactivation you have to pay a Penalty Fee of Rs. 1,000/-. Than you have to submit a request for PAN Aadhaar Linking. After that your PAN reactivation may take further 30 days.